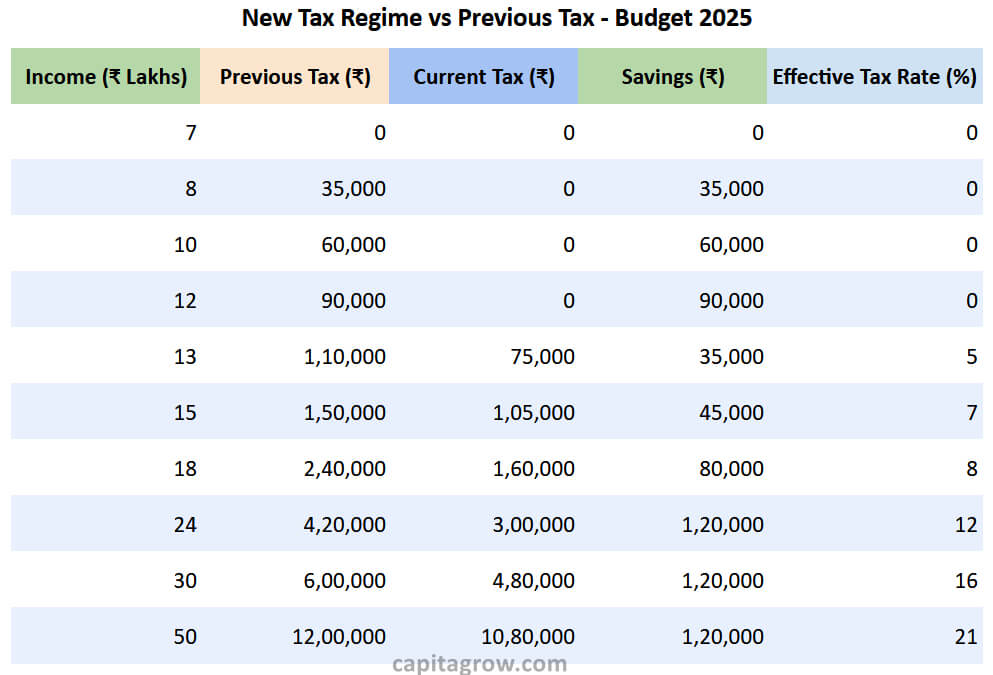

In Budget 2025 – The finance minister has announced a hike in tax rebate under Section 87A. Due to this hike, resident individuals having net taxable income up to Rs 12 lakh will pay zero tax.

Salaried individuals having standard deduction benefit of Rs 75,000 under the new tax regime will pay zero tax if gross taxable income does not exceed Rs 12.75 lakh. Current income tax laws allow zero tax on income up to Rs 7 lakh in the new tax regime.

When income tax limits are increased (i.e., the exemption limit or tax slabs are revised upward), several economic and financial effects follow:

1. Higher Disposable Income

- Taxpayers falling within the revised lower slabs or exemption limits pay less tax.

- This increases their disposable income, allowing for higher savings or spending.

2. Boost to Consumption

- With more money in hand, people tend to spend more on goods and services.

- This can drive demand, benefiting businesses and the overall economy.

3. Increased Savings & Investments

- Some individuals may choose to invest the extra income in mutual funds, stocks, fixed deposits, or retirement plans.

- This can lead to greater capital formation and long-term wealth accumulation.

4. Potential Economic Growth

- More disposable income can lead to higher economic activity, boosting GDP growth.

- The increased demand can result in higher production, employment, and business expansion.

5. Impact on Different Income Groups

- Low & Middle-Income Groups benefit the most as they save more.

- High-Income Earners may not see a major impact unless tax slabs across higher brackets are also changed.

Growth in economy leads to more profits for the companies and which in turn leads to higher markets and investments.

Here is the new Tax Slab announced in Union Budget 2025.