Indian Stock Market’s Recent Dip & Its Historic Resilience.

Over the past year, the Indian stock market has faced a downturn, with indices like the Nifty 50 and Sensex showing significant volatility. Global economic uncertainties, rising interest rates, and geopolitical tensions have all played a role in dampening investor sentiment. Additionally, concerns over inflation and foreign institutional investor (FII) outflows have put pressure on equities.

However, if history has taught us anything, it is that the Indian market has a strong track record of bouncing back. In past corrections—whether it was the 2008 financial crisis, the 2020 COVID-19 crash, or the 2013 taper tantrum—the markets eventually recovered, rewarding long-term investors. Strong economic fundamentals, corporate earnings growth, and a resilient domestic investor base have been key drivers of these rebounds.

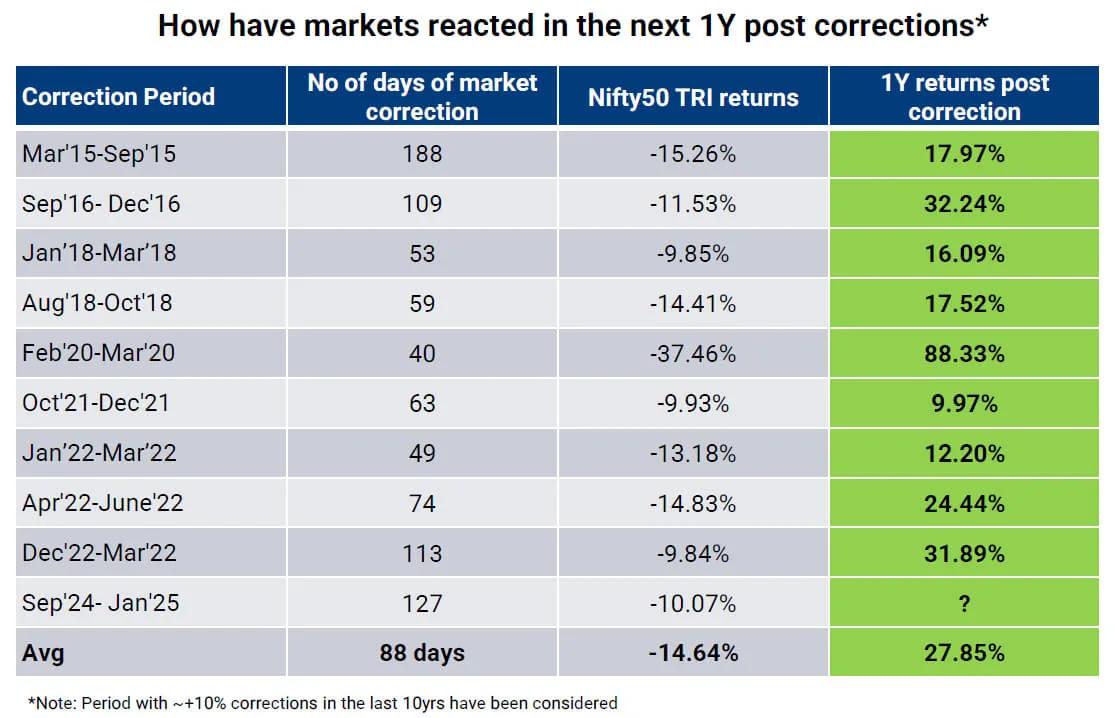

Check out the image above from Edelweiss. Whenever Nifty 50 has corrected more than 10% per year, the returns for the next year has been good.

As India continues to grow as a global economic powerhouse, periods of correction should be seen as opportunities rather than setbacks. While short-term fluctuations may cause anxiety, historical data suggests that staying invested with a long-term perspective has consistently paid off. Investors who weather the storm often emerge stronger, benefiting from the eventual market recovery.

In the words of Warren Buffett, “Be fearful when others are greedy and greedy when others are fearful.” The Indian markets may be down today, but history suggests they won’t stay that way for long.