Gold prices have been on a significant upward trajectory, driven by a combination of a weakening U.S. dollar, escalating fiscal concerns in the United States, and heightened geopolitical tensions. These factors have collectively enhanced gold’s appeal as a safe-haven asset.

Dollar Weakness Amplifies Gold’s Appeal.

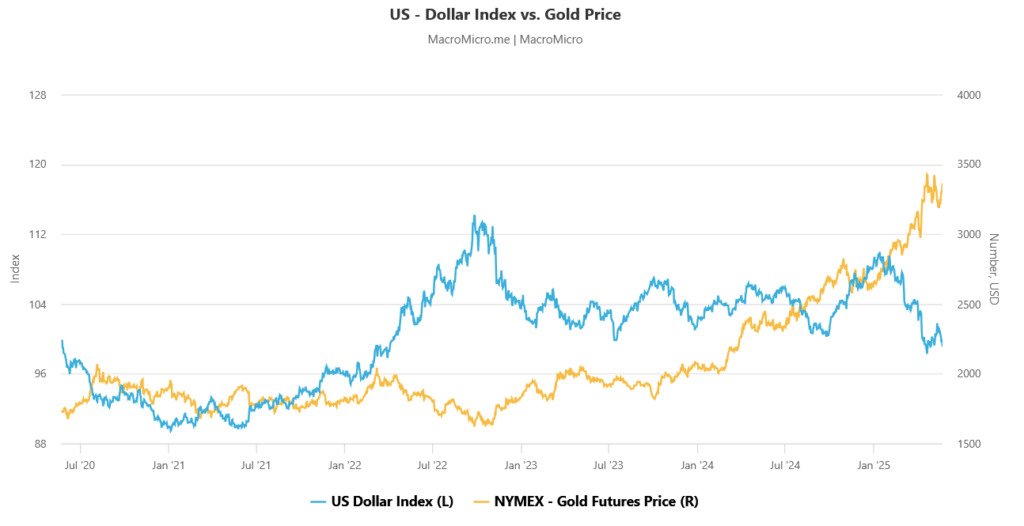

The U.S. dollar has experienced a notable decline, with the ICE U.S. Dollar Index falling nearly 4% since early April. This depreciation makes gold, which is priced in dollars, more affordable for investors using other currencies, thereby increasing demand.

Below is the comparison chart of US Dollar Index vs Gold Price.

U.S. Fiscal Instability Fuels Investor Anxiety.

Investor confidence has been further shaken by the U.S. government’s fiscal policies. The House of Representatives recently passed a substantial tax and spending bill, projected to add between $3 to $5 trillion to the national debt. This move has raised alarms about the sustainability of U.S. fiscal policy and its potential impact on the economy.

Credit Downgrade Intensifies Market Volatility.

Adding to the fiscal concerns, Moody’s Investors Service downgraded the U.S. credit rating from Aaa to Aa1, citing the growing national budget deficit and a lack of effective fiscal reforms. This downgrade has led to increased volatility in financial markets, prompting investors to seek refuge in gold.

Geopolitical Tensions and Safe-Haven Demand.

Global geopolitical uncertainties, including tensions in the Middle East and trade disputes, have further bolstered gold’s status as a safe-haven asset. As investors navigate these uncertainties, gold offers a perceived stability amidst market fluctuations.

Market Outlook.

As of May 23, 2025, spot gold is trading at approximately $3,360 per ounce (Rs.9000 per gram – 22k), marking a 4% rise for the week and its best weekly performance since early April.

Given the current economic indicators and geopolitical landscape, analysts anticipate that gold will continue to attract investors seeking to hedge against currency depreciation and market volatility.