India’s Top AMCs: Who’s Managing Our Money and Why They Matter

The mutual fund industry in India has seen remarkable growth over the past few years. As of October-2025, total Assets Under Management (AUM) have crossed ₹75 lakh crore, with investors increasingly relying on AMCs to grow and manage their wealth.

But with 50 AMCs in the market, which ones really lead? What makes them stand out? Let’s dive into India’s top AMCs by AUM, what differentiates them, and what this means for you as an investor.

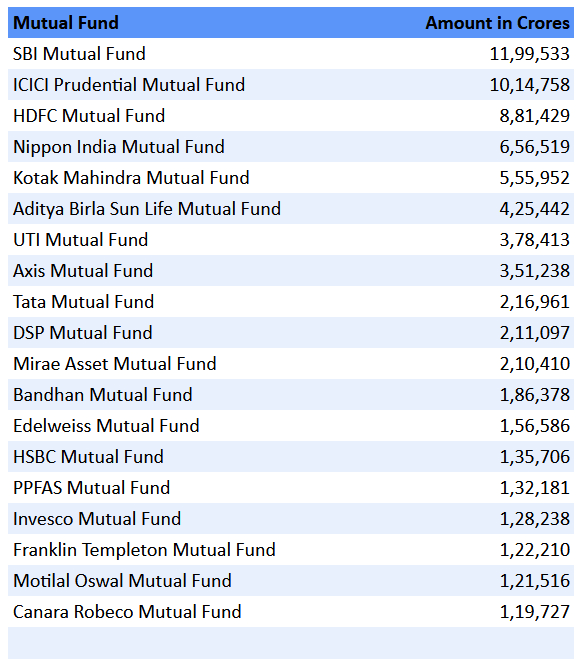

Top AMCs in India by AUM in 2025. Here are some of the biggest names, with approximate AUMs.

Is AUM size important?

While AUM size is important, there are several other factors that make certain AMCs more reliable or attractive for investors:

- Track record & Performance: Just having large AUM doesn’t always mean the best returns. Consistency over time, especially across different market cycles, matters.

- Fund variety: Equity, debt, hybrid, thematic, commodities – gold and silver ETFs — the more options, the more flexibility for investors to build diversified portfolios.

- Customer service and digital tools: SIP convenience, app/portal usability, transparency in disclosures matter a lot for retail investors.

- Regulation & governance: AMCs regulated by SEBI, strong compliance, clear disclosures reduce risk.

What It Means for Investors

- Market share: The top 10 AMCs manage ~75-80% of the mutual fund assets in India.

- Not always “bigger = better”: Sometimes smaller AMCs or newer ones punch above their weight with specialized strategies, better risk-adjusted returns or niche offerings.

- Diversification across AMCs can help: Spread your investment exposure to reduce “AMC risk” (fund manager style, strategy risk, etc.).

- Watch consistency more than trailing returns: A fund that has done well for 1 year may not maintain that. Long term 3- to 5-year consistency matters.

💡 Grow Smarter with CapitaGrow

At CapitaGrow, we help you choose funds not just based on popularity, but on performance, consistency, and alignment with your goals.

Let us guide you through selecting AMCs and mutual funds that can stand the test of time.