The Power of Compounding: The Eighth Wonder of the Financial World

Albert Einstein once called compounding the eighth wonder of the world.

“Those who understand it, earn it; those who don’t, pay it.”

In investing, compounding is nothing short of magic — it’s how small, consistent investments grow into substantial wealth over time.

And in mutual funds, especially through SIPs (Systematic Investment Plans), compounding quietly works in your favor every month.

What Is Compounding?

Compounding is the process where your returns themselves start earning returns.

It’s not just your initial investment that grows — it’s your accumulated earnings that start growing too.

Think of it like planting a tree. The first few years, growth seems slow. But once the roots deepen, the tree grows faster every year.

That’s what happens with your money when you give it time.

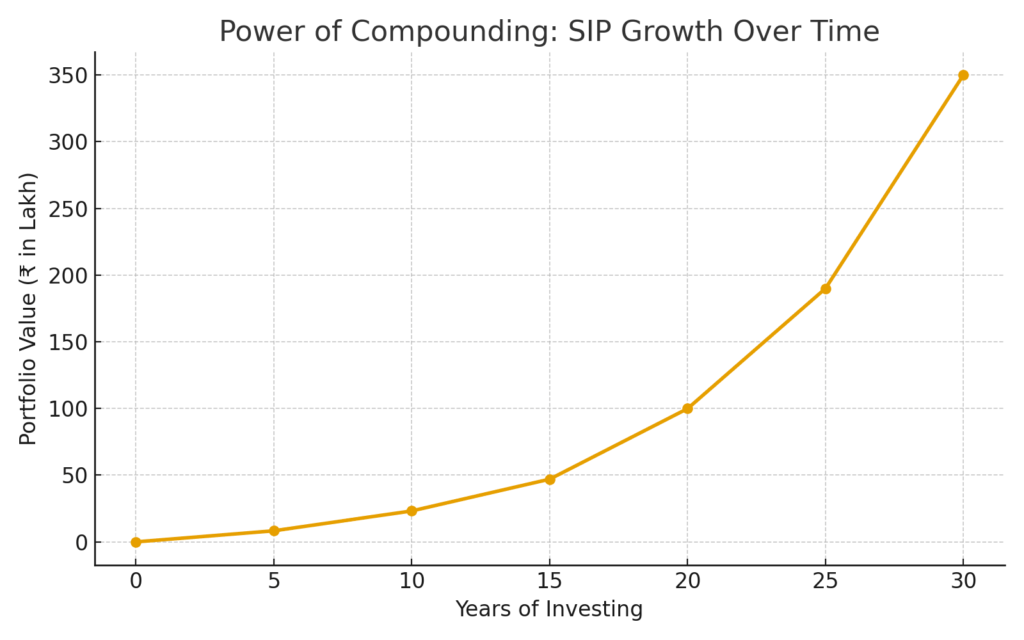

The Math Behind the Magic

Let’s take a simple example:

| Investment Type | Monthly SIP | Duration | Return (p.a.) | Value at End |

|---|---|---|---|---|

| Regular SIP | ₹10,000 | 10 years | 12% | ₹23.2 lakh |

| Regular SIP | ₹10,000 | 20 years | 12% | ₹99.9 lakh |

| Regular SIP | ₹10,000 | 30 years | 12% | ₹3.5 crore |

Notice: By investing for 3 times longer, you don’t earn 3 times more — you earn 15 times more!

That’s the power of compounding and time working together.

SIP Growth Over Time

Why Compounding Works Best with SIPs

Systematic Investment Plans (SIPs) are designed to harness compounding perfectly because:

- They’re consistent:

You invest every month, automatically adding to your base. - They benefit from rupee cost averaging:

You buy more units when prices are low, fewer when prices are high — averaging your cost over time. - They reward patience:

The longer you stay invested, the more exponential the growth becomes.

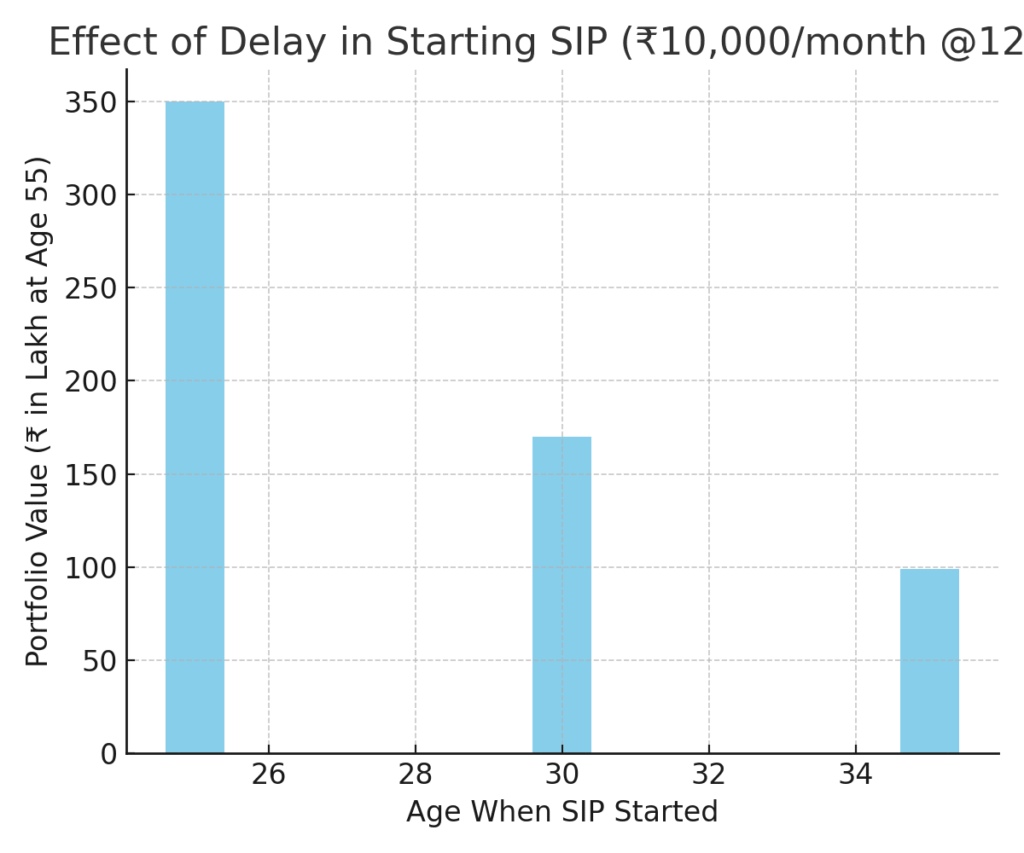

Effect of Delay in Starting SIP

| Start Age | Monthly SIP | Years of Investing | Total Invested | Value at 12% p.a. |

|---|---|---|---|---|

| 25 | ₹10,000 | 30 | ₹36 lakh | ₹3.5 crore |

| 30 | ₹10,000 | 25 | ₹30 lakh | ₹1.7 crore |

| 35 | ₹10,000 | 20 | ₹24 lakh | ₹99 lakh |

A 5-year delay nearly halves your final corpus — not because you invested less, but because you gave compounding less time to work its magic.

Time, Not Timing, Builds Wealth

Most investors spend years trying to “time the market,” but true wealth comes from time in the market.

The earlier you start, the more your money compounds — and the less pressure you feel later.

Compounding rewards patience, consistency, and discipline — not perfection.

Final Thoughts

Compounding doesn’t demand brilliance — only time and discipline.

Whether it’s ₹5,000 or ₹50,000 a month, what matters most is starting early and staying consistent.

Every SIP you start today is a small seed for your financial forest tomorrow.

Let it grow — and let time do the heavy lifting.

💡 Grow with CapitaGrow

At CapitaGrow, we help investors turn small steps into big outcomes through goal-based SIPs and disciplined investing strategies.

Start your SIP today — and experience the real power of compounding over time.