India’s consumption story is rapidly unfolding. A combination of a growing middle class, rising disposable incomes, and a youthful population is driving demand for goods and services across sectors. The economy is moving from being primarily production-driven to consumer-driven, with profound implications for investors, businesses, and policymakers.

Key Drivers of India’s Consumption Boom

- Expanding Middle Class and Disposable Income

- India’s middle class is projected to reach over 580 million by 2030.

- Rising income levels allow households to spend on discretionary goods — from smartphones and appliances to travel and lifestyle products.

- Youthful Population

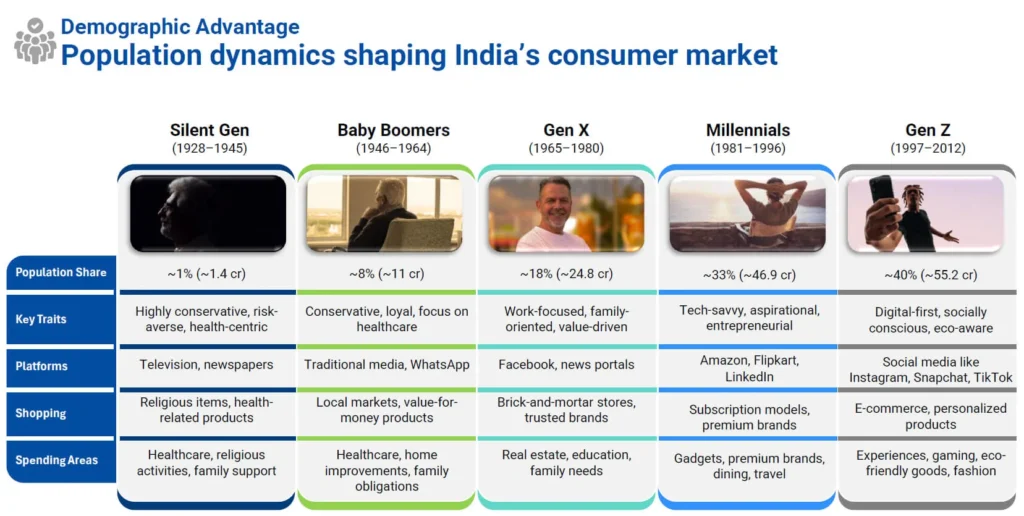

- With 50% of the population under 25 years, India is uniquely positioned for consumption-led growth.

- Young consumers are more open to new products, brands, and digital experiences, boosting sectors like technology, fashion, and entertainment.

- Digitalization and E-commerce

- Internet penetration has crossed 900 million users, enabling online shopping and access to services across urban and semi-urban India.

- Platforms like Flipkart, Amazon India, and niche e-commerce players have made products more accessible and convenient.

Sectors Benefiting from the Consumption Surge

| Sector | Trend / Impact |

|---|---|

| Food & Beverages | Increased preference for branded and processed foods; rise in online grocery platforms. |

| Technology & Electronics | Higher smartphone adoption, wearables, smart home devices; rapid online sales growth. |

| Fashion & Luxury Goods | Growing appetite for branded apparel, footwear, and luxury lifestyle products. |

| Healthcare & Wellness | Increased spending on fitness, health insurance, and wellness products. |

| Travel & Leisure | Domestic tourism and online travel booking platforms are booming. |

Investor Insight: These trends highlight opportunities in consumer stocks, mutual funds with consumption-oriented portfolios, and ETFs tracking discretionary spending.

Digital Acceleration

The pandemic accelerated digital adoption, making online shopping, digital payments, and fintech services integral to daily life.

- Digital payments have grown to over ₹10 lakh crore monthly transactions.

- E-commerce penetration is highest in metro and Tier-1 cities but rapidly expanding into Tier-2 and Tier-3 towns.

This digital wave not only boosts consumption but also creates data-driven insights for businesses to tailor offerings to consumer preferences.

Why India’s Consumption Story Matters

- For Businesses: Indicates growing market potential and scope for innovation.

- For Investors: Offers avenues to invest in consumption-oriented funds, stocks, and ETFs.

- For Policymakers: Highlights the need to support infrastructure, digital inclusion, and supply chains.

Takeaway

India’s consumption story is not just about rising numbers; it reflects a transforming economy, evolving lifestyles, and a youthful population embracing new experiences. Investors who understand these consumption trends can strategically position their portfolios to capture the long-term growth potential.

Grow Smarter with CapitaGrow

At CapitaGrow, we help you identify opportunities in India’s growing consumer economy, whether through mutual funds, equity portfolios, or sectoral investments.

Explore consumption-driven investment opportunities at capitagrow.com