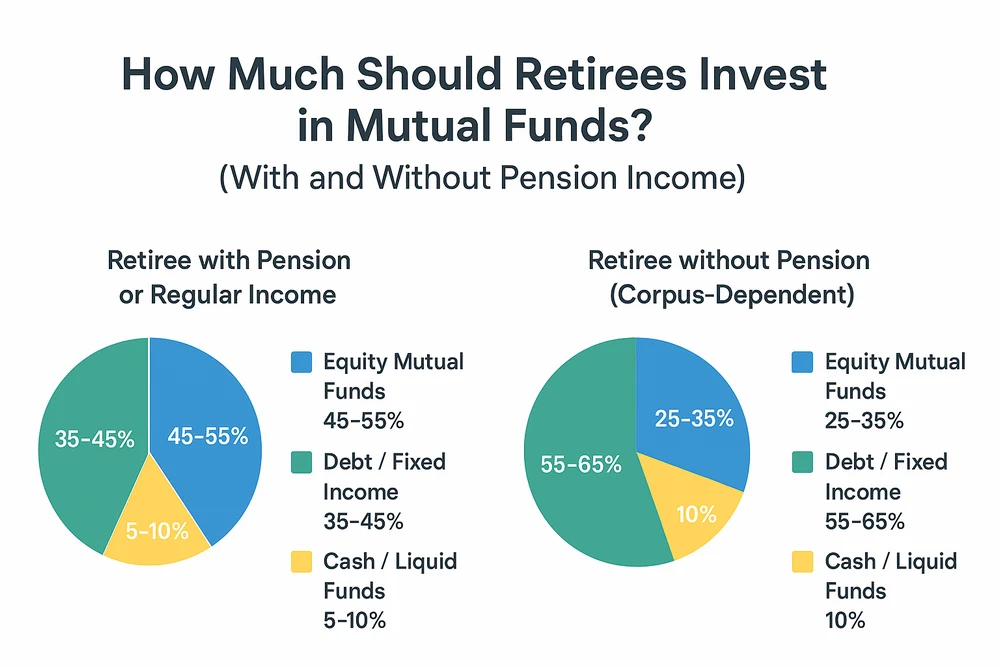

How Much Should Retirees Invest in Mutual Funds? (With and Without Pension Income)

Retirement brings freedom from work — but it also brings the responsibility of managing your savings wisely. One of the most common questions retirees face is:

“How much of my money should I keep in risky assets like equity mutual funds?”

The right answer depends largely on whether you have a regular pension or not. Let’s explore both scenarios with practical examples and guidance.

Why Some Equity Exposure Is Important

Even after retirement, your money needs to continue working for you. With life expectancy increasing and inflation rising, a retiree’s portfolio should still have growth assets to maintain purchasing power.

Purely debt-based portfolios may look safe but often fail to beat inflation over 20–30 years.

That’s why a balanced approach — combining equity and debt — works best.

Scenario 1: Retiree with Pension or Regular Income

If you receive a monthly pension, annuity, or rental income, you have a steady cash flow that covers day-to-day expenses. This allows you to take slightly more risk in pursuit of higher long-term returns.

| Category | Suggested Allocation |

|---|---|

| Equity Mutual Funds | 45–55% |

| Debt / Fixed Income | 35–45% |

| Cash / Liquid Funds | 5–10% |

Example:

A 60-year-old with ₹1 crore and ₹50,000 monthly pension may invest:

- ₹50 lakh in equity mutual funds.

- ₹40 lakh in short-term debt or income funds.

- ₹10 lakh in liquid funds (for 2–3 years of expenses)

This approach helps the portfolio grow while keeping sufficient safety and liquidity.

Scenario 2: Retiree without Pension (Corpus-Dependent)

If your retirement expenses depend entirely on your savings, preserving capital becomes more important. You’ll still need some equity exposure — but it should be limited and carefully managed.

| Category | Suggested Allocation |

|---|---|

| Equity Mutual Funds | 25–35% |

| Debt / Fixed Income | 55–65% |

| Cash / Liquid Funds | 10% |

Example:

A 60-year-old with ₹1 crore and no pension may invest:

- ₹30 lakh in equity mutual funds.

- ₹60 lakh in fixed income / debt instruments.

- ₹10 lakh in liquid funds for 2–3 years of expenses.

This ensures stability and predictable cash flow, while equity helps offset inflation over time.

Key Takeaways for Both Cases

- Maintain 3–5 years of expenses in low-risk or liquid funds.

- Prefer Systematic Withdrawal Plans (SWPs) from balanced or hybrid funds over lump-sum withdrawals.

- Review and rebalance annually — shift profits from equity to debt to protect gains.

- Choose tax-efficient mutual funds to optimize post-tax returns.

Bottom Line

For most retirees, a 25–45% equity allocation works well — lower if you depend solely on your corpus, and higher if you have pension income.

The goal isn’t to chase high returns but to ensure steady income, inflation protection, and peace of mind.

Need help designing your ideal retirement portfolio?

👉 CapitaGrow can help you create a balanced, inflation-adjusted investment plan for a worry-free retirement.