Top SIP Mistakes Investors Should Avoid.

Systematic Investment Plans (SIPs) have become one of the most popular ways for Indians to invest in mutual funds. By investing a fixed amount regularly, investors benefit from rupee cost averaging and the power of compounding.

Yet, despite its simplicity, many investors lose out due to avoidable mistakes. Understanding and avoiding these can make a significant difference to your long-term wealth creation journey.

1. Stopping SIPs During Market Downturns

One of the biggest blunders is stopping SIPs when markets fall. This is when SIPs work hardest for you — buying more units at lower prices. When markets recover, those extra units accelerate your returns.

Example:

During the 2020 COVID market crash, investors who continued their SIPs saw stronger 3-year returns than those who paused them.

Tip: Continue SIPs even in falling markets — volatility is your friend in the long run.

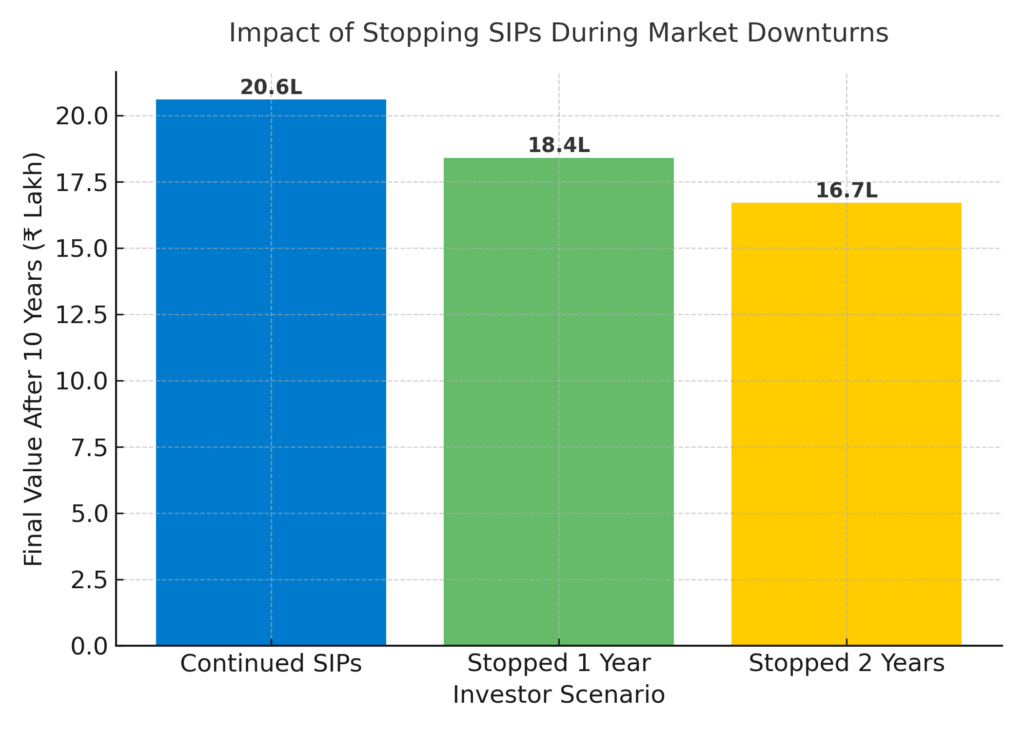

Chart: Impact of Continuing vs Stopping SIPs During a Market Downturn

| Scenario | SIP Duration | Monthly SIP (₹) | Average Market Return (p.a.) | Final Value (After 10 Years) |

|---|---|---|---|---|

| Continued SIP through downturns | 10 years | ₹10,000 | 11% | ₹20.6 lakh |

| Stopped SIP for 1 year during fall | 9 years active | ₹10,000 | 11% | ₹18.4 lakh |

| Stopped SIP for 2 years during fall | 8 years active | ₹10,000 | 11% | ₹16.7 lakh |

2. Expecting Quick Results

SIPs are long-term vehicles — not short-term trading tools. Many investors stop after a couple of years, expecting instant results.

Tip: Give equity SIPs at least 5–7 years to show compounding benefits.

3. Chasing High-Performing Funds

Switching SIPs frequently to chase the latest “top performer” is counterproductive. Fund performance rotates, but your long-term strategy should not.

Tip: Choose diversified funds based on your risk profile and stay consistent.

4. Ignoring Goal-Based Planning

Without a defined goal, it’s easy to withdraw early or stop investing. Linking SIPs to goals — like retirement, education, or buying a home — provides purpose and discipline.

Tip: Assign a clear time horizon and target value for each SIP.

5. Not Reviewing Periodically

While SIPs require patience, they still need an annual review to ensure they align with your risk appetite, asset allocation, and financial goals.

Tip: Review once a year — not every month. Avoid unnecessary fund switches.

Key Takeaways

- SIPs work best when continued through all market conditions.

- Avoid chasing returns or stopping during market corrections.

- Link SIPs to clear goals for better discipline.

- Stay patient — compounding rewards consistency.

At CapitaGrow, we help investors design goal-based SIP portfolios that stay resilient across market cycles and deliver consistent, long-term growth.

Start your SIP journey with CapitaGrow today