The Psychology of Investing: Why Patience Pays

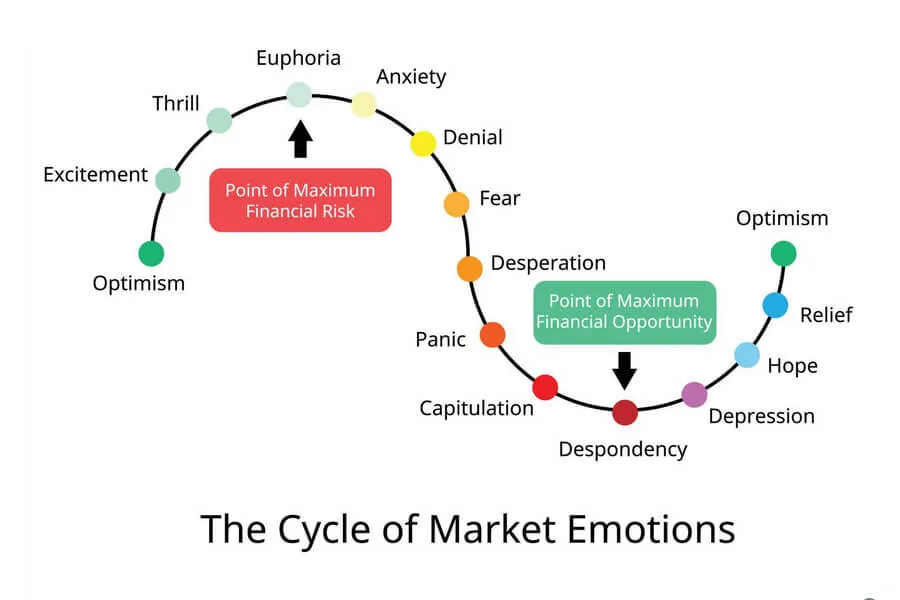

Investing is not just about numbers, charts, or stock prices — it’s about human behavior. Many investors know what they should do: stay invested for the long term, diversify, and avoid panic during market downturns. Yet, when markets fluctuate, emotions often override logic. This is where investor psychology and behavioral finance come in. Understanding how emotions and biases affect decisions can make you a more disciplined and successful investor.

Understanding Investor Psychology

Investor psychology refers to the emotions and cognitive biases that influence investment decisions. People are not always rational when dealing with money — fear, greed, and overconfidence often drive market behavior more than fundamentals.

Common emotional reactions include:

- Fear of loss: Selling investments too soon when markets fall.

- Greed: Chasing high returns or “hot” sectors without research.

- Herd mentality: Following others blindly during bull or bear runs.

- Regret aversion: Avoiding necessary risks because of past mistakes.

Recognizing these patterns is the first step to overcoming them.

Behavioural Finance Simplified

Behavioural finance combines psychology and economics to explain why investors often act irrationally. Some key concepts include:

- Loss Aversion: People feel the pain of a loss more than the joy of an equivalent gain. This often leads to holding on to poor investments too long or avoiding the market after a fall.

- Recency Bias: Giving too much importance to recent performance and ignoring long-term potential.

- Confirmation Bias: Focusing only on information that supports one’s beliefs and ignoring contrary evidence.

- Overconfidence Bias: Overestimating one’s ability to predict market movements.

When investors understand these biases, they can make better, more rational choices.

Why Patience is the Ultimate Investing Edge

Time in the market — not timing the market — is the real wealth builder. Patience allows the power of compounding to work in your favor. Consider this: a 12% annual return doubles your money roughly every six years. But to enjoy that growth, you must stay invested through both market ups and downs.

History shows that markets reward patience:

- Short-term volatility is common, but long-term returns are consistently positive for diversified equity investors.

- Investors who resist panic selling during downturns tend to outperform those who react emotionally.

A long-term mindset helps smooth out temporary market noise and keeps focus on goals — not daily fluctuations.

Building a Long-Term Investing Mindset

- Set clear goals: Invest with a defined purpose — retirement, children’s education, or wealth creation.

- Automate investments: Regular SIPs reduce emotional decision-making.

- Ignore short-term noise: Market headlines change daily; focus on the long-term trend.

- Diversify: Balance across equity, debt, and gold to reduce emotional stress from volatility.

- Review periodically, not frequently: Checking your portfolio every day fuels anxiety. A quarterly or half-yearly review is enough.

Key Takeaways

- Investor psychology plays a major role in success — managing emotions is as important as selecting good funds.

- Understanding behavioral biases helps avoid costly mistakes.

- Patience, discipline, and a long-term perspective are the true foundations of wealth creation.

At CapitaGrow, we help investors develop the right mindset — not just portfolios. Talk to our advisors to align your investments with your long-term financial goals.