Why Children Mutual Funds Are Essential

Introduction

Planning for a child’s future is one of the biggest financial responsibilities for any parent. Education costs are rising sharply, lifestyle needs are evolving, and long-term financial security requires early and disciplined planning. This is where Children Mutual Funds offer a structured, goal-oriented investment solution designed specifically for future needs such as higher education, career development, or important life milestones. In a world where expenses increase every year, a dedicated children’s fund can help parents stay ahead without financial stress.

What Are Children Mutual Funds?

Children mutual funds are hybrid or debt-oriented mutual fund schemes designed to help parents build a long-term corpus for their children. These funds typically come with an optional lock-in period, encouraging disciplined investing and preventing premature withdrawals. They are structured to balance safety and growth, making them suitable for long-term goals of 10–18 years.

Why Children Mutual Funds Are Essential

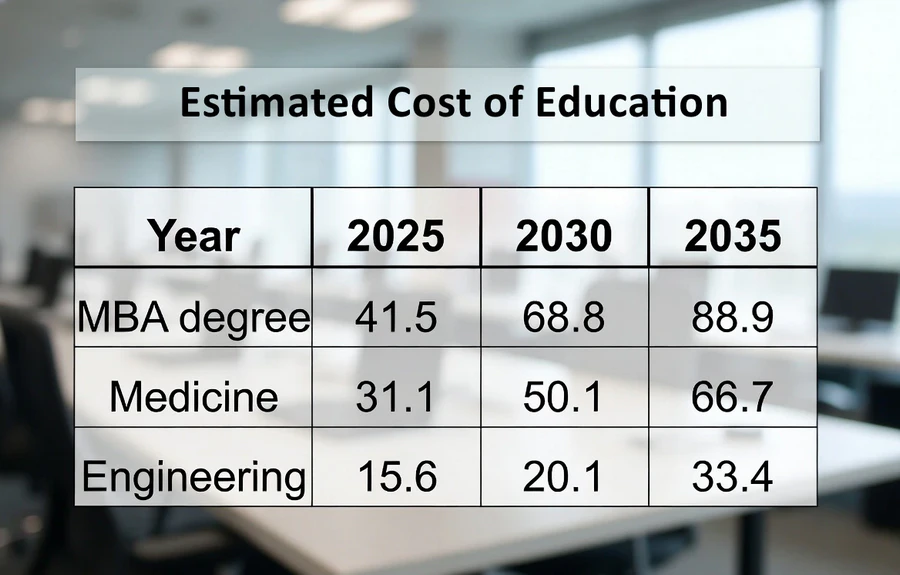

1. Rising Cost of Education

Education inflation in India is far higher than normal household inflation. Professional courses, international education, and skill-based programs can become significantly more expensive by the time today’s children reach college. A children’s fund, through SIPs or lump-sum contributions, helps beat inflation by investing in growth-oriented assets such as equities. The longer the horizon, the higher the potential compounding effect.

2. Goal-Based Discipline

Parents often invest randomly—FDs, recurring deposits, gold, or small savings schemes—without a unified long-term plan. Children mutual funds provide a dedicated structure where the purpose is clearly defined. The presence of a lock-in or exit load discourages early withdrawals, helping parents stay disciplined and ensuring the corpus remains untouched until needed.

3. Power of Early and Systematic Investing

Starting a children’s fund when the child is young allows investments to compound for 10–15 years. Even a small SIP grows significantly when given enough time. For example, a ₹5,000 monthly SIP growing at 10% annually can accumulate more than ₹15 lakh in 15 years. Early planning ensures parents are not forced to borrow or liquidate assets later during critical milestones.

4. Reduces Dependency on Loans

Education loans are widely used but come with interest rates that increase the burden on families and children. A well-planned mutual fund corpus reduces or eliminates the need for educational loans, allowing children to start their careers without debt pressure.

5. Designed for Child’s Long-Term Security

These funds are structured to support broader life goals beyond education. They help build a foundation for future needs such as entrepreneurial pursuits, skill development, or international exposure. The fund remains in the child’s name and supports financial independence when they reach adulthood.

6. Tax Efficiency Compared to Traditional Saving Options

Children mutual funds, depending on the investment type, can be more tax-efficient than fixed deposits or recurring deposits. Long-term capital gains tax on equity assets remains relatively low, enabling parents to retain more of their returns. Over long durations, tax efficiency plays a critical role in corpus growth.

Takeaways

Children mutual funds are not just an investment product—they are a financial planning tool that brings discipline, inflation protection, and long-term growth. For parents aiming to secure their child’s education and future milestones, starting early with a structured children’s fund provides clarity and confidence. The combination of professional management, goal alignment, and compounding makes these funds essential for modern financial planning.

If you want to build a secure and inflation-proof future for your child, CapitaGrow can help you select the right children’s mutual fund and design a long-term SIP plan tailored to your goals. Contact capitagrow.com to get started with a personalised investment plan.

Author: Rajesh Narayanan

Rajesh Narayanan writes for CapitaGrow on investing, mutual funds, and long-term wealth planning. He focuses on helping families build financial security through disciplined and goal-based investing.

Leave a Reply