NSE Trading Holidays 2026: Key Dates Every Investor Should Know

Introduction

For active investors, traders, and even long-term SIP participants, trading holidays on the National Stock Exchange (NSE) matter more than we think. These are the days when equity, F&O, currency, and commodity trades remain shut, and therefore execution, settlement, and NAV pricing may shift. Planning ahead helps avoid last-minute surprises, especially around expiry days, IPO listings, or major market events.

This guide explains what the NSE holiday calendar typically includes, how it affects trading, and practical steps to plan your investment activity ahead of time.

What are NSE trading holidays?

NSE trading holidays are predefined dates when trading sessions remain closed across market segments. These are declared annually by the exchange and are based on national festivals, major events, government notifications, and regional observances.

Holidays impact:

• Equity trading.

• F&O expiry schedules.

• Mutual fund settlement and NAV calculation.

• Banking and payment cycles (especially settlement days).

For short-term traders, derivative participants, and those using intraday strategies, holiday and shortened trading sessions are very relevant.

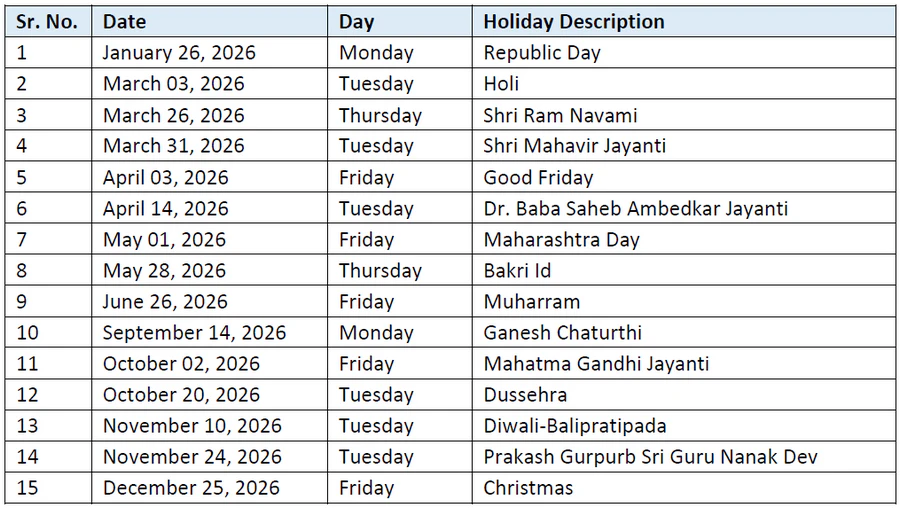

NSE trading List holidays for 2026

Special note: Muhurat Trading 2026

The most anticipated session every year is the Diwali Muhurat Trading window. This symbolic one-hour session marks the beginning of the new financial year as per the Hindu calendar. Many investors participate as a goodwill and Lakshmi-Pujan tradition. NSE will announce the exact 2026 Muhurat timing separately.

Impact of holidays on settlement and NAV

A closed trading day does not always mean closed settlement. However, NAV processing for mutual funds can shift depending on the category. Hybrid and debt funds sometimes follow different cut-offs. For SIP investors, holidays generally do not impact long-term compounding, but short-term NAV fluctuations may move execution dates.

Tips for investors and traders

Plan expiry trades around long weekends.

Watch for monthly or weekly expiry moving dates.

Remain alert near major events like Union Budget.

Check bank settlement days for large transfers.

Note timings for commodity evening sessions.

Avoid last-minute order execution ahead of holidays.

Quick FAQ

Does SIP get skipped?

If the SIP date falls on a holiday, it normally gets processed on the next business day.

Do all segments close together?

Not always. Equity, derivatives, and commodities may follow different closing rules.

Are weekends included?

Yes, markets are closed on Saturdays and Sundays.

Takeaways

Trading holidays are predictable, but planning ahead prevents execution issues. Whether you are a trader or an investor, understanding market closure days helps manage trades, avoid delays, and plan cash flows efficiently.

To stay updated with confirmed holiday dates, market announcements, and new NSE circulars, follow CapitaGrow insights on Indian markets at capitagrow.com.

Author

Written by Rajesh Narayanan, a financial content specialist and MFD focusing on financial awareness, mutual funds, and personal finance.

Leave a Reply