Understanding The Hidden Costs Of Investment Delays.

Why You Should Start Investing Earlier.

When it comes to mutual funds, delaying investments can significantly impact your financial goals. Mutual funds are designed to grow wealth over time, but procrastination can erode their potential benefits. Here’s how:

Loss of Compounding Power

The earlier you invest in mutual funds, the more time your money has to grow through the power of compounding. Compounding allows your returns to generate additional returns, creating exponential growth over time. A delay of even a few years can drastically reduce the final corpus, especially for long-term goals like retirement.

Market Opportunities

Mutual funds, particularly equity-oriented ones, perform well over the long term despite market volatility. Delaying your entry means missing out on periods of growth or market recoveries. Over time, these missed opportunities can significantly impact returns.

Higher Financial Burden

The longer you wait, the more you’ll need to invest each month to achieve the same financial goals. Starting small and early with systematic investment plans (SIPs) reduces this burden, while delaying forces you to commit larger sums later, which may strain your finances.

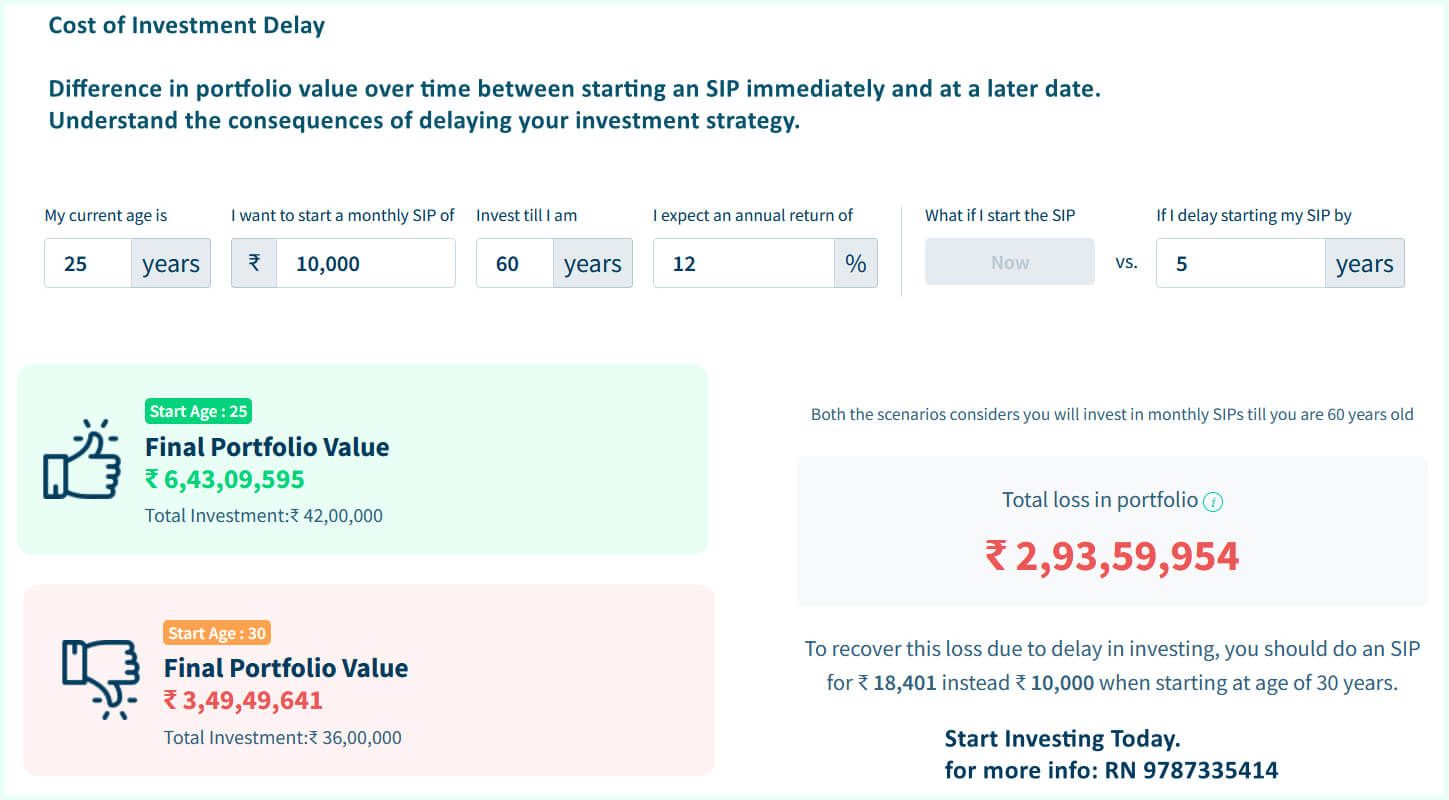

Check the above image.

A delay in 5 years, increases the SIP amount to Rs.18,000 instead of Rs.10,000. Also, there is a big difference in final portfolio of starting early vs delaying by 5 years.

Check out these calculator to find out how much SIP is required for your target amount.

Conclusion

Procrastinating on mutual fund investments is a costly mistake. The earlier you start, the greater your ability to harness compounding, ride out market volatility, and achieve your financial goals. Start small if needed, but start now—because time in the market always beats timing the market.