Can India Become a $10 Trillion Economy – and What It Means for Investors

Introduction

India’s economic journey has been nothing short of remarkable. From a $1 trillion economy in 2007 to nearly $4 trillion in 2025, the country has emerged as one of the fastest-growing major economies in the world. But the next big question now dominates headlines — can India become a $10 trillion economy, and what does that mean for investors?

This isn’t just a number. It’s a vision that connects policy reforms, digital transformation, demographics, and entrepreneurial energy — all of which create long-term opportunities for wealth creation.

India’s Path to $10 Trillion: How Realistic Is It?

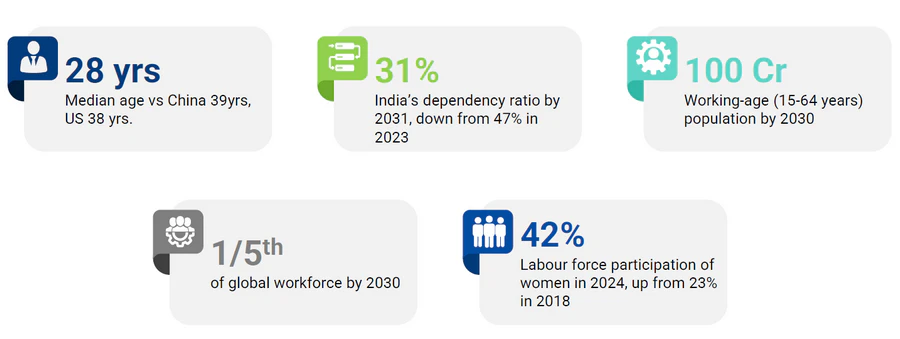

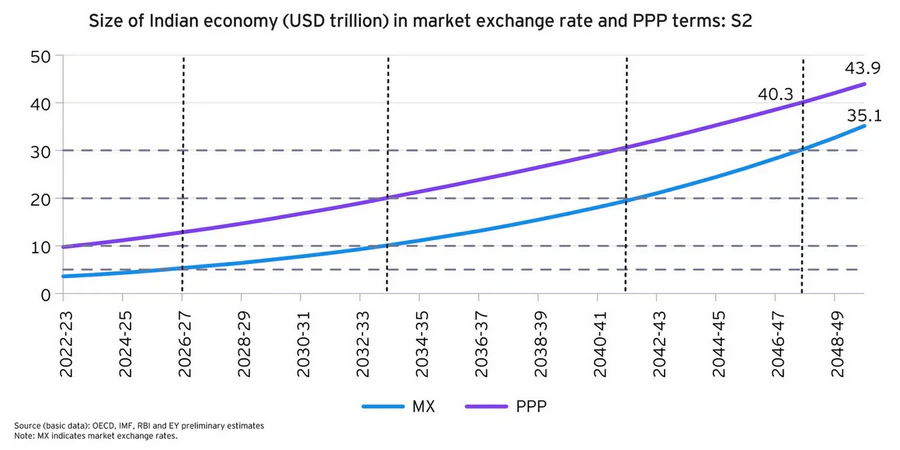

According to estimates from several global institutions, India could reach a $10 trillion GDP between 2030 and 2035, provided its current growth trajectory continues.

Key drivers supporting this growth include:

- Demographic Dividend – Over 65% of India’s population is under 35, creating a massive workforce and consumer base.

- Digital Transformation – From UPI to ONDC, India’s digital public infrastructure is unmatched, driving efficiency and inclusion.

- Manufacturing and Exports – The Make in India and PLI schemes are boosting industrial capacity and global competitiveness.

- Urbanisation and Infrastructure – Smart cities, highways, renewable energy and logistics are creating long-term economic multipliers.

- Financialisation of Savings – More Indians are moving from gold and real estate to mutual funds, equity, and insurance.

If India maintains an average nominal GDP growth rate of 9–10%, crossing $10 trillion within 10-15 years is achievable.

What a $10 Trillion India Means for Investors

A growing economy translates into expanding businesses, rising incomes, and new investment opportunities. For investors, this long-term trend has powerful implications.

1. Equity Markets Reflect Economic Growth

As the economy grows, corporate earnings tend to rise — and equity markets mirror that growth over time. Historically, countries that moved from developing to middle-income stages saw their stock markets compound significantly.

2. Mutual Funds: The Simplest Route to Participate

Investors need not pick individual stocks to benefit from India’s growth story. Equity mutual funds provide diversified exposure across sectors — banking, IT, manufacturing, consumption, and infrastructure — which are likely to be the biggest beneficiaries of India’s structural transformation.

3. SIPs Work Best in Long-Term Growth Phases

When the macro trend is strong, volatility becomes your ally. Systematic Investment Plans (SIPs) allow you to capture India’s compounding story, rupee by rupee, month by month.

For example, ₹10,000 per month invested over 20 years at 12% annualized returns can grow to nearly ₹99 lakh — all by staying consistent.

4. Global Flows Will Add Strength

A growing GDP and stable governance attract global capital. As India’s weight rises in global indices, foreign investors will allocate more to Indian equities, supporting valuations and liquidity.

Sectors That Could Lead the Next Decade

- Financial Services: Banks, NBFCs, and fintechs expanding into Bharat.

- Manufacturing: Electronics, defence, chemicals, and auto ancillaries.

- Infrastructure: Roads, power, housing, and renewable energy.

- Digital & AI: Startups leveraging India’s vast data ecosystem.

- Consumption: As incomes rise, lifestyle and discretionary spending soar.

Long-term investors can position through diversified mutual fund portfolios covering these growth themes.

Challenges to Watch

While optimism is justified, investors should stay mindful of:

- Policy implementation and execution delays

- Global interest rate and trade cycle impacts

- Inflation and currency volatility

- Income inequality and job creation balance

These are normal in any high-growth economy — they don’t derail the long-term potential but reinforce the need for discipline and diversification.

Takeaways

- India’s path to a $10 trillion economy is credible, backed by reforms, demographics, and digital scale.

- Investors should align with this growth through equity mutual funds and SIPs.

- Volatility will be part of the journey — but the direction is clear: upward and forward.

- The earlier you start investing, the more of India’s future you own.

The India growth story isn’t just for economists — it’s for investors who think long term.

Start your Mutual Fund Investments via SIPs with CapitaGrow.

Contact CapitaGrow.com to explore tailored mutual fund portfolios designed for India’s decade of opportunity.

One response to “Can India Become a $10 Trillion Economy – and What It Means for Investors”

[…] investing through diversified equity funds, a disciplined, long-horizon approach aligned with India’s growth remains a proven […]