Multi Asset Allocation Funds

Introduction

Every investor knows the golden rule — don’t put all your eggs in one basket. Yet, many portfolios still depend heavily on either equity or debt, missing the power of true diversification.

That’s where Multi Asset Allocation Funds come in.

These funds invest across equity, debt, and gold (and sometimes international assets) within a single scheme, helping you balance risk and reward through market cycles. For investors who prefer simplicity with intelligent diversification, multi-asset funds can be a smart solution.

What Are Multi Asset Allocation Funds?

A Multi Asset Allocation Fund is a type of mutual fund that invests in at least three asset classes, with a minimum of 10% exposure to each.

Typical allocation mix:

- Equity – for long-term growth

- Debt – for stability and income

- Gold or other commodities – for inflation protection and diversification

The fund manager dynamically adjusts allocations based on market conditions to optimize returns while managing volatility.

Why Multi Asset Funds Make Sense

- Built-in Diversification

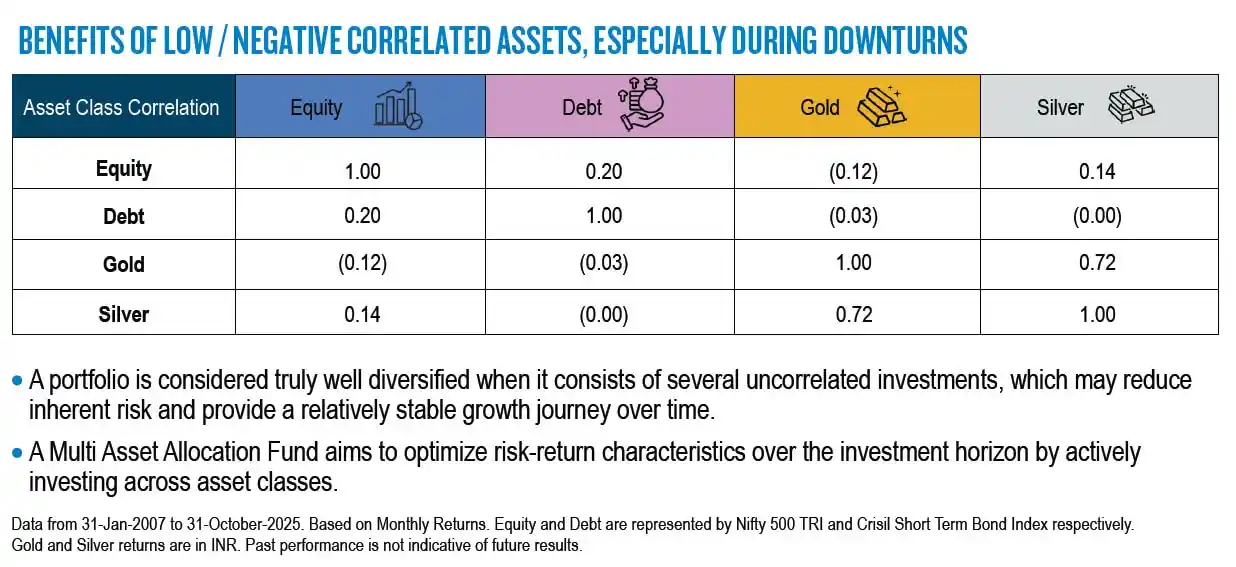

Instead of juggling multiple funds, one scheme gives you exposure to different asset classes — equity, debt, and gold — reducing portfolio concentration risk. - Lower Volatility

When equities face corrections, debt and gold often provide stability. The combined effect smoothens portfolio returns over time. - Professional Asset Allocation

Fund managers monitor markets and rebalance automatically, removing the need for investors to decide when to switch or reallocate. - Ideal for Moderate Investors

For investors who want growth but dislike large swings in NAV, multi asset funds offer a balanced approach. - Tax Efficiency

Many of these funds are treated as equity-oriented for taxation if equity exposure stays above 35%. That means long-term capital gains (LTCG) tax of 10% after one year, which is tax-efficient compared to pure debt investments.

How Multi Asset Allocation Works: Example

| Asset Class | Allocation (%) | Purpose |

|---|---|---|

| Equity | 50% | Capital appreciation |

| Debt | 30% | Stability and income |

| Gold | 20% | Inflation hedge and diversification |

If equity markets fall, gold or debt often cushion the decline. Conversely, when equity rallies, the portfolio participates in the upside.

Who Should Invest in Multi Asset Funds

Multi asset funds are ideal for:

- New investors seeking diversified exposure through one product

- Investors with moderate risk tolerance

- Those preferring auto-rebalancing without monitoring markets daily

- SIP investors aiming for steady, balanced wealth creation

If you’re unsure about how much to invest in equity, debt, or gold, this category offers a convenient, all-in-one solution.

Risks and Points to Note

- Returns may be lower than pure equity funds during strong bull markets.

- Ideal investment horizon: at least 3–5 years to let the asset mix deliver results.

Takeaways

- Multi asset allocation funds provide diversification, balance, and simplicity.

- They help investors participate in growth while cushioning against market volatility.

- A disciplined SIP in such a fund can help build wealth steadily across economic cycles.

For many investors, they are the “one-stop portfolio” for long-term investing.

Looking for a diversified, all-in-one investment option?

Explore multi asset allocation funds with CapitaGrow.com

2 responses to “Multi Asset Allocation Funds: The Smart Way to Diversify Your Investments”

[…] you’re evaluating how gold fits into your long-term investment strategy, portfolio diversification, or asset allocation, CapitaGrow can help you structure a disciplined approach aligned with your […]

[…] Multi-asset allocation funds, which balance equity, debt and other assets, delivered superior performance relative to many standard equity categories in 2025. These funds benefited from the rally in precious metals and diversified income sources, making them among the best-performing categories outside traditional equities. […]