In 2024, mutual fund SIPs in India have seen a significant increase, driven by a combination of strong market performance and rising investor confidence.

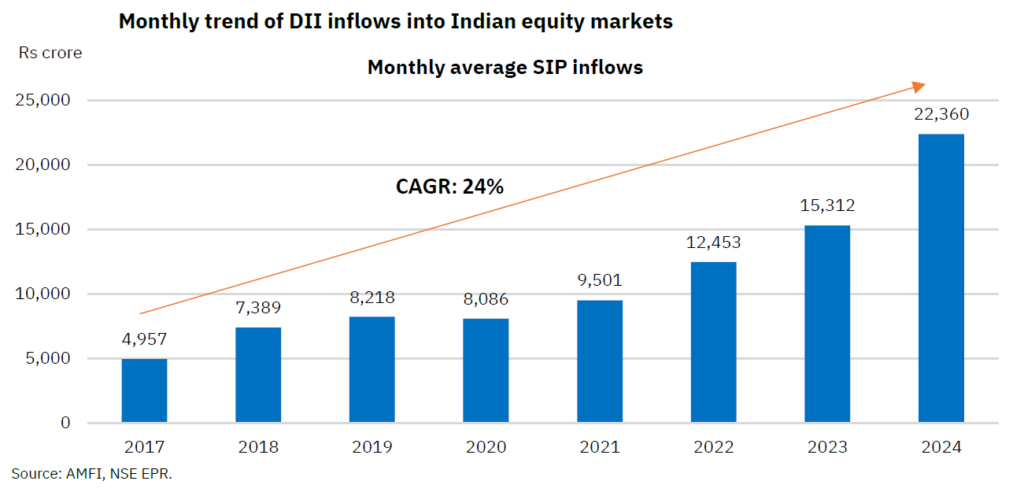

The above image shows the SIP surge over the past many years. At the end of 2024, the Mutual Fund SIP stands at Rs.26,459 crores, a 600% increase since 2016.

Retail investors are increasingly drawn to SIPs due to their ease of access, the potential for compounding returns, and the ability to invest small amounts regularly. With greater financial literacy and improved digital infrastructure, more Indians are opting for SIPs to build wealth over the long term.

This growth is also fueled by the country’s expanding middle class, a favorable economic environment, and the shift from traditional savings instruments to more lucrative investment options.

Check out why mutual funds are ideal for investors.