Introduction

One of the most important — yet often overlooked — principles of investing is asset allocation. It determines how your portfolio is divided among different asset classes such as equity, debt, and gold.

While many investors focus on selecting the “right” mutual fund or stock, studies consistently show that asset allocation drives a majority of long-term portfolio returns, not individual investment choices.

A well-balanced allocation helps investors manage risk, capture growth, and stay on track with financial goals despite market ups and downs.

What Is Asset Allocation?

Asset allocation is the process of distributing your investments across multiple asset types to achieve an optimal balance between risk and return.

| Asset Class | Risk Level | Typical Return (p.a.) | Purpose |

|---|---|---|---|

| Equity | High | 10–14% | Long-term growth, wealth creation |

| Debt | Low to Moderate | 6–8% | Stability, regular income |

| Gold | Moderate | 6–8% | Inflation hedge, diversification |

| Cash/Liquid Funds | Very Low | 3–4% | Liquidity, short-term goals |

Why Asset Allocation Matters

1. Balances Risk and Return

When equity markets fall, debt or gold often hold value — helping reduce overall volatility.

2. Improves Long-Term Returns

Systematically allocating to growth and defensive assets helps investors capture market upside while avoiding panic during downturns.

3. Aligns with Financial Goals

Short-term goals (like buying a car) need safer assets, while long-term goals (like retirement) benefit from higher equity exposure.

How to Decide Your Asset Allocation

A simple rule of thumb is:

Equity allocation = 100 – your age

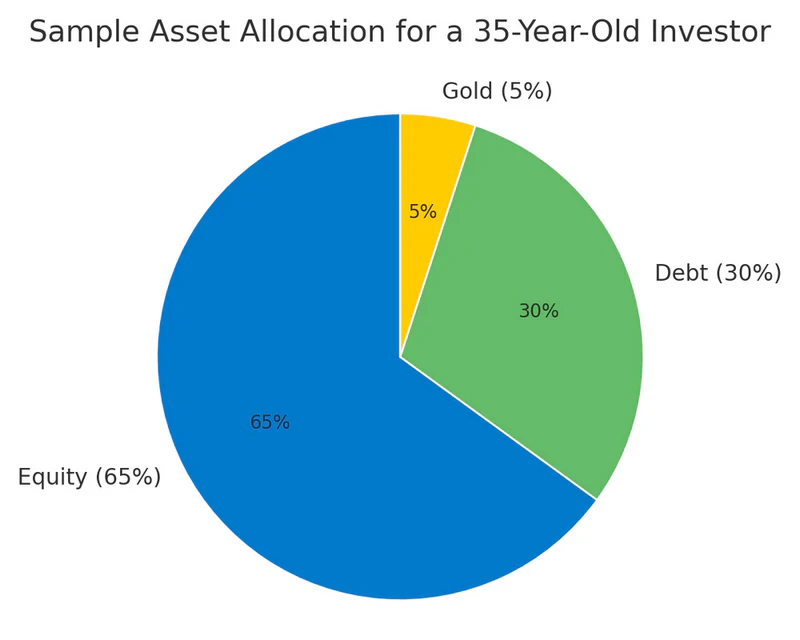

For example, a 35-year-old could have around 65% in equity, 30% in debt, and 5% in gold.

This balance can be refined based on:

- Risk tolerance

- Investment horizon

- Financial goals

Mutual funds make this easy through hybrid or balanced funds, which automatically maintain a mix of equity and debt.

Asset Allocation Varies by Age, Financial Capacity, and Risk Profile

There’s no one-size-fits-all formula for asset allocation. It evolves with your age, financial situation, and comfort with risk.

- Age: Younger investors can afford a higher equity exposure since they have time to ride out market volatility. As retirement approaches, shifting toward debt and stable instruments helps preserve capital.

- Financial Capacity: Those with stable incomes, emergency reserves, or multiple income sources can take greater investment risk.

- Risk Profile: Conservative investors may prefer safety and predictable returns, while aggressive investors can accept higher volatility for the chance of superior long-term gains.

The key is to align your allocation with your goals and temperament — not with market noise or short-term performance trends.

Review and Rebalance Regularly

Asset allocation is not a one-time decision. As markets move and goals evolve, portfolios drift from their target mix.

Rebalancing — adjusting investments back to the desired allocation — helps maintain your risk-return balance.

Example:

If equity grows faster and becomes 75% of your portfolio (vs target 65%), shifting part to debt brings it back in line.

Key Takeaways

- Asset allocation is the foundation of smart investing.

- Diversification across equity, debt, and gold helps reduce risk.

- Regular review and rebalancing ensure alignment with your goals.

- Mutual funds simplify asset allocation through hybrid options.

At CapitaGrow, we help investors design goal-based portfolios with optimal asset allocation — ensuring the right mix of growth, safety, and liquidity.

Plan your investments smartly at capitagrow.com