How Global Events Affect Indian Mutual Funds

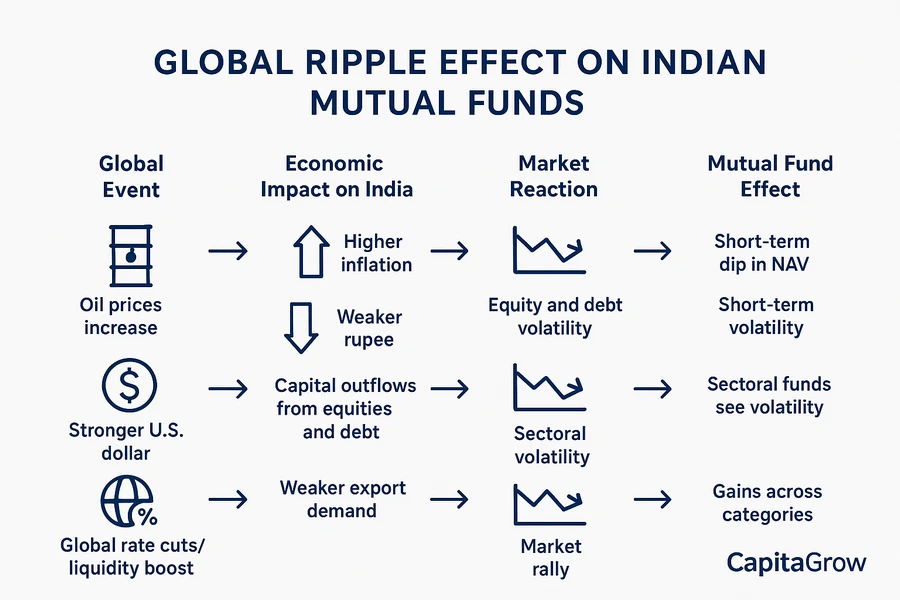

Indian mutual fund investors often focus on domestic factors—company earnings, interest rates, or government policies. However, global events can significantly influence how your mutual fund portfolio performs.

From oil price movements to currency fluctuations and trade policies, global developments shape market sentiment, liquidity, and returns. Understanding these links helps investors make better decisions and avoid reacting emotionally to short-term volatility.

1. The Interconnected World of Markets

Today’s financial markets are deeply connected. When global investors move money in or out of emerging markets like India, it impacts stock prices, bond yields, and the rupee’s value.

For instance, a U.S. interest rate hike can lead to foreign investors withdrawing funds from India, causing the rupee to weaken and equity markets to correct in the short term.

Key takeaway: Even though you invest in Indian mutual funds, global capital flows and investor sentiment directly influence your returns.

2. Oil Prices and the Indian Economy

India imports over 80% of its crude oil needs. Hence, rising oil prices affect:

- Inflation: Higher fuel costs raise transportation and manufacturing expenses.

- Current Account Deficit: More dollars are spent on imports, pressuring the rupee.

- Corporate Profits: Industries like airlines, transport, and FMCG face margin pressure.

When crude prices rise sharply, it can lead to short-term corrections in equity mutual funds, especially in sectors dependent on fuel or imports. Conversely, falling oil prices usually benefit Indian markets and boost mutual fund NAVs.

3. Rupee vs Dollar: The Currency Connection

The rupee-dollar exchange rate plays a crucial role in determining mutual fund returns, particularly for:

- Export-oriented sectors (IT, pharma): A weaker rupee increases export revenues.

- Import-dependent sectors (automobile, electronics): A weaker rupee increases input costs.

For investors in international mutual funds or funds with overseas exposure, a stronger dollar can enhance returns when converted back to rupees — even if the foreign fund’s local performance is stable.

Example:

If the U.S. market rises 5% and the dollar strengthens 3% against the rupee, your overseas mutual fund may deliver roughly 8% return in INR terms.

4. Global Trade and Tariffs

Trade tensions and tariffs—like those between major economies such as the U.S. and China—can affect:

- Global supply chains

- Commodity prices

- Investor risk appetite

For India, tariffs or global slowdowns can reduce export demand and affect manufacturing-linked sectors. Mutual funds with exposure to industrial, metal, or export-driven companies may see volatility during such periods.

However, trade disruptions can also create opportunities—global firms may diversify supply chains to India, benefiting sectors like manufacturing, logistics, and capital goods over time.

5. Global Interest Rates and Liquidity

When the U.S. Federal Reserve or the European Central Bank changes interest rates, it influences global money flows:

- Higher global rates → foreign investors pull out of emerging markets → equity and debt fund volatility.

- Lower global rates → increased liquidity → more foreign investment inflows into India → market rally.

This is why Indian equity and debt mutual funds often react even to announcements made by global central banks.

6. How Investors Should Respond

Global events are unpredictable, but they are part of investing.

Instead of reacting to every headline:

- Focus on long-term goals, not short-term volatility.

- Maintain asset allocation based on your risk profile.

- Diversify across equity, debt, and gold to balance global shocks.

- Continue your SIPs — volatility often creates better entry opportunities.

Long-term investors who stay invested through global ups and downs usually benefit from India’s underlying growth potential.

Takeaways

- Global factors like oil, currency, and trade directly affect Indian mutual fund returns.

- A rising dollar or oil price can weaken the rupee and pressure corporate earnings.

- Tariffs and global liquidity shifts can impact sectors differently.

- Stay invested, stay diversified — reacting emotionally can hurt long-term returns.

At CapitaGrow, we help investors navigate market volatility with the right mutual fund mix.

Get personalized guidance to protect and grow your wealth — even in uncertain global times.

2 responses to “How Global Events Affect Indian Mutual Funds”

[…] Foreign investors may remain cautious due to currency risk, potentially slowing equity flows. […]

[…] Global macroeconomic headwinds: global rate hikes, dollar strength, or external shocks can impact foreign inflows to Indian markets. […]