Investing for Your Child’s Education: SIP or Other Options?

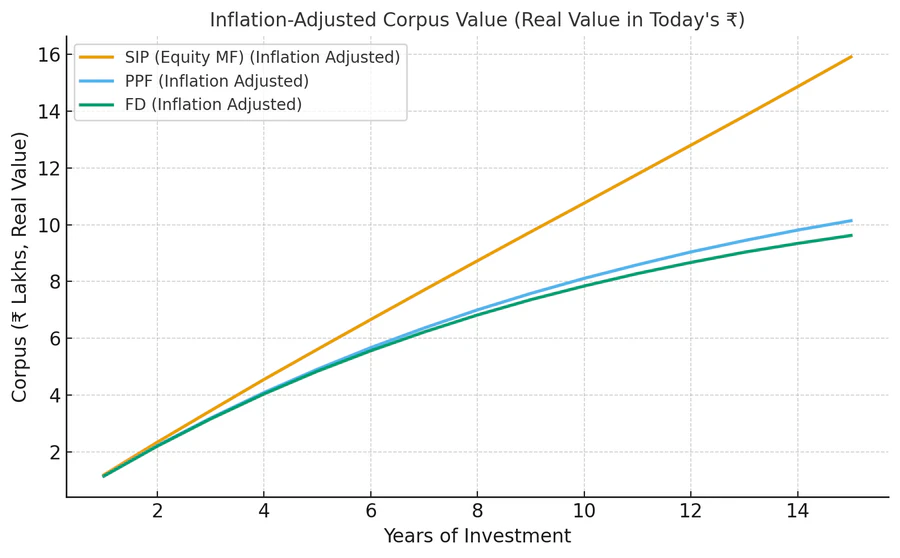

Providing your child with quality education is one of the biggest financial goals for any parent. But with education costs rising 8–10% annually, traditional savings like bank deposits or PPF may not keep up.

A Systematic Investment Plan (SIP) in mutual funds offers a smarter, inflation-beating way to build the required corpus over time. Here’s a comparison between SIPs, PPF, and FDs — and how to plan effectively.

Understanding the Goal: Rising Cost of Education

Education inflation in India is among the highest globally.

A program costing ₹20 lakh today could cost ₹40–50 lakh in 10–12 years.

To meet this goal, you need investments that outpace inflation, not just preserve capital.

Option 1: SIP in Mutual Funds

A Systematic Investment Plan (SIP) allows you to invest a fixed amount regularly in a mutual fund scheme. Equity SIPs, in particular, are ideal for long-term goals like education.

Benefits of SIP for Child Education

- Beats inflation: Historical equity mutual fund returns average 10–12% p.a.

- Flexibility: Start with ₹500/month and increase gradually (Step-Up SIP).

- Liquidity: Redeem partially or fully when the goal nears.

- Compounding: Early investors benefit most.

Example:

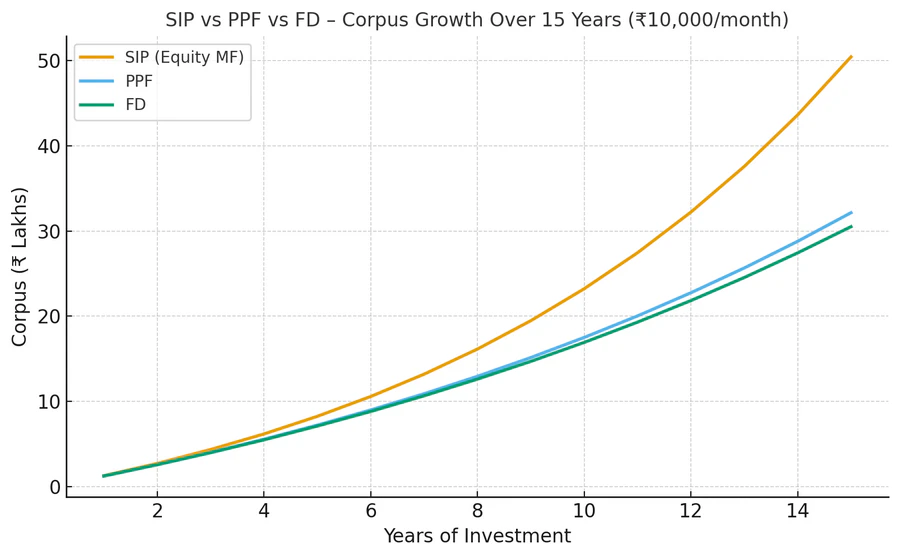

A SIP of ₹10,000/month for 15 years at 12% returns can grow to ₹50 lakh+, sufficient for higher education goals.

Option 2: Public Provident Fund (PPF)

PPF is a safe, government-backed investment with a 15-year lock-in and current interest rate of 7.1% p.a.

Pros:

- Guaranteed returns.

- Tax-free maturity.

- Eligible under Section 80C.

Cons:

- Lower returns compared to inflation.

- Limited liquidity.

PPF is reliable but may fall short of education inflation unless combined with growth-oriented investments.

Option 3: Fixed Deposits (FDs)

Bank FDs offer safety and predictable returns (6–7%), but they are not ideal for long-term goals due to taxation and inflation erosion.

Pros:

- Safe and easy to manage.

- Flexible tenures.

Cons:

- Interest is taxable.

- No inflation protection.

- Poor compounding effect.

FDs work better for short-term goals, such as fees due within 1–3 years.

SIP vs PPF vs FD – Comparison Table

| Feature | SIP (Mutual Funds) | PPF | Fixed Deposit |

|---|---|---|---|

| Expected Returns | 10–12% | 7.1% | 6–7% |

| Inflation Protection | Yes | Partial | No |

| Risk Level | Moderate | Low | Low |

| Liquidity | Flexible | 15-year lock-in | Moderate |

| Tax Benefit (80C) | Yes (ELSS) | Yes | Yes (5-year FD) |

| Best For | Long-term goals (10–15 yrs) | Long-term safety | Short-term parking |

Chart 1: Corpus Growth Over 15 Years

Chart 2: Inflation-Adjusted Value (Real Corpus in Today’s ₹)

Planning Timeline and Inflation Adjustment

Example:

- Current cost: ₹15 lakh

- Inflation: 8%

- Time horizon: 15 years

- Future cost: ₹47 lakh

To reach ₹47 lakh in 15 years (at 12% returns), invest about ₹8,500/month.

Delaying by 5 years doubles the required SIP to ₹17,000/month — proving the importance of starting early.

Check out CapitaGrow Investment Calculators to calculate exact amount.

Smart Strategy: Combine Growth and Safety

For a balanced plan:

- Use Equity SIPs for long-term growth.

- Use PPF or Debt Funds for stability.

- Shift gradually from equity to debt 3–4 years before goal.

This ensures both wealth creation and capital protection.

Key Takeaways

- Start early; let compounding work over time.

- Combine SIPs with safer assets for balance.

- Increase SIPs annually with income growth.

- Avoid relying solely on fixed-return instruments.

Plan your child’s education fund smartly with goal-based SIPs on CapitaGrow.com.