UDGAM Portal: How to Find and Claim Unclaimed Money in Banks.

Introduction

Many Indians are unaware that thousands of crores of rupees lie unclaimed in dormant or forgotten bank accounts. To address this, the Reserve Bank of India (RBI) launched the UDGAM portal (Unclaimed Deposits – Gateway to Access Information) — a centralised online platform that helps individuals search for and claim unclaimed money lying with multiple banks in India.

With just a few clicks, you can check if you or your family have unclaimed deposits, and then initiate a claim through your bank. This article explains what unclaimed deposits are, how UDGAM works, and the exact process to recover your funds safely.

1. What Are Unclaimed Deposits?

Under RBI regulations, any account becomes “unclaimed” when there’s no customer activity for 10 years or more. This includes:

- Savings or current accounts with no transactions.

- Fixed or recurring deposits not renewed or withdrawn after maturity.

- Other credit balances or term deposits lying idle for 10+ years.

Banks are required to transfer these amounts to the RBI’s Depositor Education and Awareness (DEA) Fund, but depositors or legal heirs can claim the money anytime through the original bank branch.

2. Why Does Money Become Unclaimed?

- Account holders forget old or inactive accounts.

- Death of account holder without nominee awareness.

- Change of address or phone number without updating bank records.

- Overlooked fixed deposits after maturity.

- Accounts opened for specific purposes (e.g., education, marriage) that were never closed.

As a result, unclaimed deposits across Indian banks now exceed ₹42,000 crore as per RBI estimates (2025).

3. What Is the UDGAM Portal and How It Helps

UDGAM — short for Unclaimed Deposits – Gateway to Access Information — is an initiative launched by the RBI in August 2023 to help depositors quickly locate their unclaimed funds across multiple banks in one place.

Key features of the UDGAM portal:

- Covers most major banks that hold over 90% of unclaimed deposits in India.

- Allows search using account holder’s name and one ID (PAN, Voter ID, Passport, etc.).

- Displays unclaimed deposit details and bank branch information.

- Enables easy follow-up with the respective bank for claiming funds.

- Free to use for all individuals.

Official website: https://udgam.rbi.org.in/unclaimed-deposits/#/login

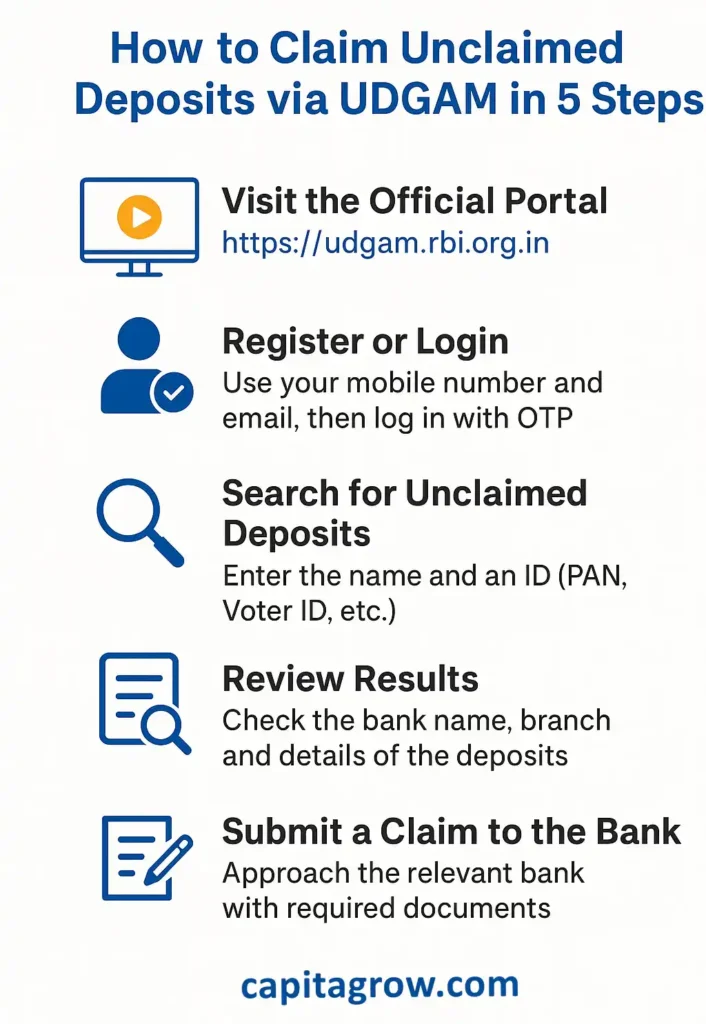

4. Step-by-Step: How to Check and Claim Unclaimed Deposits on UDGAM

Step 1: Visit the official portal

Go to https://udgam.rbi.org.in

Step 2: Register or Login

Use your mobile number and email ID to register, then log in using OTP authentication.

Step 3: Search for Unclaimed Deposits

Enter the account holder’s name and select a bank or “All Banks.”

Then input one identifier — PAN, Voter ID, Driving Licence, Passport, or Date of Birth.

Step 4: Review Results

If unclaimed deposits are found, the portal will display the bank name, branch, and reference details.

Step 5: Submit a Claim to the Bank

Approach the relevant bank branch with:

- Valid ID and address proof.

- Proof of account ownership or deposit (if available).

- Death certificate and legal heir/nominee documents (if applicable).

The bank will verify details and process your claim. Even if the funds are transferred to the DEA Fund, you can still receive them via the bank.

5. RBI and Bank-Specific Portals

While UDGAM is the central platform, several banks also publish their own lists of unclaimed deposits for independent checking:

- State Bank of India (SBI): https://sbi.co.in/web/personal-banking/information-services/deaf-claim

6. Important Tips and Precautions

- Keep all your bank accounts KYC-compliant and active with at least one transaction every few months.

- Always nominate a family member or legal heir in your accounts.

- Inform family about your existing accounts and FDs to avoid funds going unclaimed.

- Avoid third-party “agents” claiming to help recover deposits for a fee — the process is free through your bank.

- Track old accounts and investments when you change jobs, cities, or banks.

Takeaways

- The UDGAM portal is the safest and most efficient way to locate unclaimed deposits across banks in India.

- You can claim unclaimed deposits anytime by approaching the respective bank.

- Maintain KYC, update contact details, and nominate heirs to prevent funds from becoming unclaimed.

Checking UDGAM once a year ensures no part of your savings remains forgotten.

If you’d like professional assistance in investments, contact CapitaGrow today. Visit www.capitagrow.com to learn more.

Author Bio

Author: Rajesh Narayanan

Rajesh is a financial content specialist and MFD focusing on banking awareness, mutual funds, and personal finance. Through CapitaGrow, he helps investors discover, recover, and grow their wealth with clarity and confidence.

3 responses to “UDGAM Portal: How to Find and Claim Unclaimed Money in Banks”

[…] will shift to QR-based scanning instead of photocopy submissions.• Hotels, telecom operators, banks, event venues, and other service providers will need to adopt QR-based verification systems.• […]

[…] deposits within ₹5 lakh per […]

[…] an investor running five SIPs of ₹2,000 each from a private bank account. If all five debits fail in a month and the bank charges ₹500 per bounce, the total penalty […]