India’s SIP Inflows Hit Record High in 2025: What Investors Should Know

Introduction

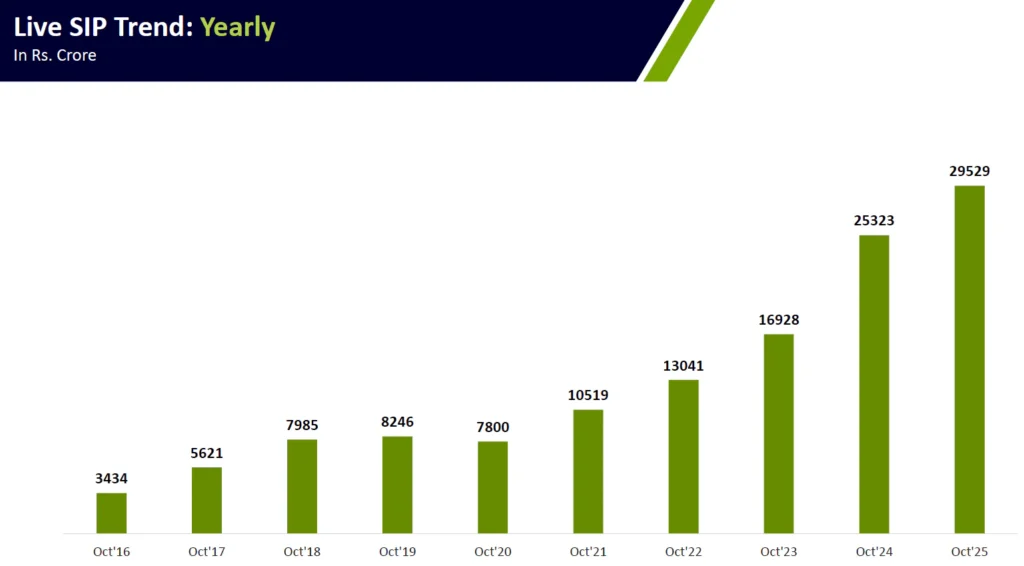

Systematic Investment Plans (SIPs) have become the backbone of India’s retail investing landscape. 2025 has become a landmark year for India’s mutual fund industry. Systematic Investment Plans (SIPs) are witnessing unprecedented participation, with monthly inflows touching nearly ₹30,000 crore, the highest ever. India’s mutual fund AUM has crossed ₹80 lakh crore, driven strongly by retail investors adopting disciplined investing habits.

This surge is not just a short-term trend; it reflects a structural shift in how Indians save, invest, and build long-term wealth.

Why SIP Inflows Are Surging in 2025

SIP growth in 2025 is not accidental. Several long-term factors have converged to support this rise:

1. Retail Investor Participation is Expanding

More first-time investors are entering mutual funds through SIPs. Digital onboarding, simple KYC processes, and user-friendly investment apps have reduced friction and encouraged small-ticket participation.

2. Growing Trust in Mutual Funds

After years of consistent returns, investors increasingly view mutual funds as a core wealth-creation tool. SIPs, in particular, are associated with discipline, convenience, and reduced timing risk.

3. Higher Disposable Income and Financialisation

Rising incomes, urbanisation, and increasing financial literacy have encouraged households to move savings away from traditional instruments like bank deposits and gold into market-linked investments.

4. Market Volatility Favouring Rupee-Cost Averaging

Periods of market corrections in 2024–25 helped investors buy more units at lower prices, reinforcing the long-term advantages of SIPs. Investors now understand that volatility is an opportunity, not a threat.

5. Strong Performance of Equity Funds

Equity mutual funds, especially large & mid-cap and flexi-cap categories, have delivered consistent long-term returns. This has strengthened investor conviction in staying invested through SIPs.

What Investors Should Do in 2025

Given the sharp rise in SIP activity, investors should align their strategy to maximise long-term benefits:

Stay Consistent

SIP returns depend on time in the market, not timing the market. Consistency matters more than short-term performance.

Review Asset Allocation

As SIPs grow, portfolios may become equity-heavy. A periodic asset allocation check ensures the right balance of equity, debt, and gold.

Align SIPs With Financial Goals

Map your SIPs to specific milestones such as retirement, children’s education, home purchase, or wealth creation. Goal-linked investing improves discipline and reduces emotional decision-making.

Avoid Stopping SIPs During Market Corrections

Corrections offer the best opportunity for compounding. Pausing SIPs during downturns can negatively impact long-term returns.

Consider Step-Up SIPs

A step-up SIP or annual increase in SIP amount helps investors match rising incomes and accelerate goal achievement.

Key Takeaways

- SIP inflows in 2025 are at historic highs, showing strong investor confidence.

- Structural changes such as rising incomes, financial literacy, and digital adoption are driving long-term SIP growth.

- Equity markets remain volatile, but disciplined SIP investors continue to benefit from rupee-cost averaging.

- Aligning SIPs with long-term financial goals and maintaining consistency can significantly improve wealth outcomes.

Author Bio

Written by Rajesh Narayanan, a financial content specialist and MFD focusing on financial awareness, mutual funds, and personal finance.

Leave a Reply