Silver Prices Are Booming Again: What the 1980 Hunt Brothers Crash Teaches Investors Today

Introduction

Silver prices are once again in the spotlight. Rising inflation concerns, industrial demand from clean energy, and renewed interest in precious metals have pushed silver back into investor conversations. As prices move sharply higher, many investors are asking whether silver represents an opportunity or a risk at current levels.

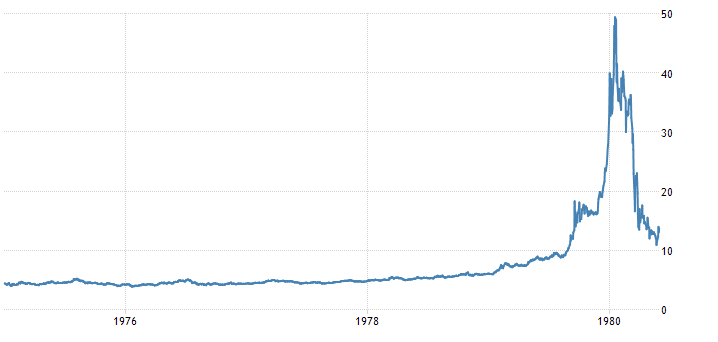

History provides a valuable reference point. The last time silver experienced a dramatic price surge driven by investor enthusiasm was in the late 1970s, culminating in the famous Hunt Brothers episode of 1980. A clear look at that timeline helps investors understand both the potential and the risks in today’s silver rally.

The 1980 Silver Boom: A Timeline Investors Should Remember

Early 1970s: Inflation and Loss of Currency Confidence

After the US abandoned the gold standard in 1971, global inflation rose sharply. Confidence in paper currencies weakened, and investors increasingly turned to real assets such as gold and silver for protection.

During this phase, the Hunt brothers began accumulating physical silver as a long-term hedge against currency debasement.

1973–1978: Steady Accumulation

Silver purchases continued quietly for several years. Holdings were largely physical and relatively unleveraged. Prices moved higher gradually, without public excitement or speculative frenzy.

This period represented the most stable phase of the silver rally.

1979: The Shift to Leverage

As inflation surged again following oil shocks, silver prices accelerated. The Hunt brothers significantly increased exposure through silver futures contracts, introducing leverage into the strategy.

Rising prices attracted momentum-driven investors. Silver moved rapidly from single digits to over $30 per ounce. Media attention intensified, and silver became a popular inflation hedge narrative.

January 1980: Peak Optimism

Silver prices touched nearly $50 per ounce, an all-time high. At this stage, a concentrated group of investors effectively controlled a large share of deliverable silver.

Speculation peaked, expectations became extreme, and risk was largely ignored.

February–March 1980: Rule Changes and Forced Selling

Commodity exchanges raised margin requirements and imposed position limits. “Liquidation-only” trading rules were introduced, preventing new long positions.

Highly leveraged investors faced margin calls and were forced to sell into falling markets.

March 27, 1980: Silver Thursday

Silver prices collapsed sharply in a matter of days, falling more than 50 percent. Eventually, prices dropped below $11 per ounce.

The Hunt brothers defaulted on loans, faced lawsuits, and were later declared bankrupt. What began as an inflation hedge ended as a classic example of leverage-driven collapse.

What Caused the Crash

The silver crash was not triggered by falling industrial demand or easing inflation. It was caused by:

- Excessive leverage

- Concentrated ownership

- Regulatory intervention

This distinction is critical for modern investors. Prices can fall sharply even when the long-term story appears intact.

Lessons for Today’s Silver Investors

Leverage Is the Biggest Risk

Silver’s 1980 collapse shows that leverage, not volatility alone, destroys capital. Even fundamentally strong themes can unravel when margin requirements change.

Commodity Prices Can Overshoot

When investment demand overwhelms real usage, prices can rise far beyond sustainable levels. Silver’s 1980 peak remains far above its inflation-adjusted value even today.

Regulation Can Change Market Dynamics Overnight

Commodity markets are particularly sensitive to regulatory action. Position limits and margin hikes can reverse trends abruptly.

Silver Is More Volatile Than Gold

Gold primarily acts as a monetary hedge. Silver combines monetary and industrial characteristics, making it more cyclical and more volatile during both rallies and downturns.

How Today’s Silver Rally Compares

The current silver rally, from USD30 to USD 80, is supported by real factors such as renewable energy demand, electronics manufacturing, and diversification away from fiat currencies. These drivers provide structural support.

However, investor behaviour shows familiar patterns. Rapid price appreciation attracts speculative participation, short-term narratives, and return-chasing. History suggests that such phases increase risk, even when fundamentals appear favourable.

This does not mean silver should be avoided. It means silver should be approached with allocation discipline, not enthusiasm driven by recent returns.

Where Silver Fits in a Long-Term Portfolio

For most investors, silver works best as a small diversifier, not a core portfolio asset. It can complement gold, equities, and debt, but cannot replace them.

A sound portfolio strategy prioritises:

- Asset allocation over market timing

- Risk control over return chasing

- Long-term goals over short-term price movements

Silver can add balance, but only in moderation.

Takeaways for Investors

- Silver rallies can be sharp and emotionally compelling

- History shows that extreme moves often reverse painfully

- Leverage and concentration magnify losses

- Portfolio discipline matters more than price forecasts

The 1980 silver crash was not a failure of silver itself, but a failure of excess and overconfidence. That lesson remains highly relevant today.

If you are considering adding silver to your portfolio, focus on allocation discipline and long-term objectives, not short-term price momentum.

Explore goal-based, diversified investing strategies at CapitaGrow.

Author Bio

Rajesh Narayanan

AMFI-registered Mutual Fund Distributor and founder of CapitaGrow. He focuses on investor education, portfolio discipline, and long-term wealth creation through structured investment strategies.

Leave a Reply